Tax Rates

Taxes are calculated based on your property assessment as determined by the Municipal Property Assessment Corporation (MPAC). To establish your property's assessed values MPAC uses a system called Current Value Assessment or CVA. It analyzes sales of comparable properties in the area.

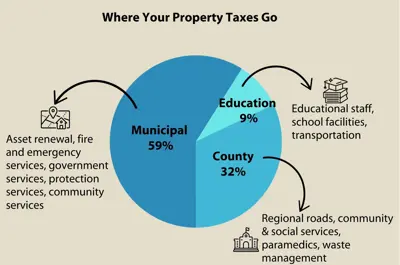

As an example, here's how your tax bill is divided for an average home in Cobourg.

An average assessed value for a home in Cobourg for 2023 is $277,200 which results in a property tax bill of $4,146 which is distributed as follows:

$2,354 goes to Cobourg

$1,368 goes to Northumberland County

$424 goes to pay for education

Council approved the 2025 Capital Budget in the amount of $111,482,784 and Operating Budget with a Municipal Levy of $32,688,195. This represents a 6.55% increase over the 2024 Operating Budget and a 5.23% net increase after allowing for New Assessment Growth of 2.32% and an infrastructure levy of 1.00%.

Contact Us

Town of Cobourg

55 King Street West

Cobourg, ON K9A 2M2

Phone: 905-372-4301

Toll Free: 1-888-972-4301

Sign up for our Newsletters

Stay up to date on the Town of Cobourg's activities, events, programs and operations by subscribing to our eNewsletters.